Strategies Vα

What is a Strategy in version Alpha (α)?

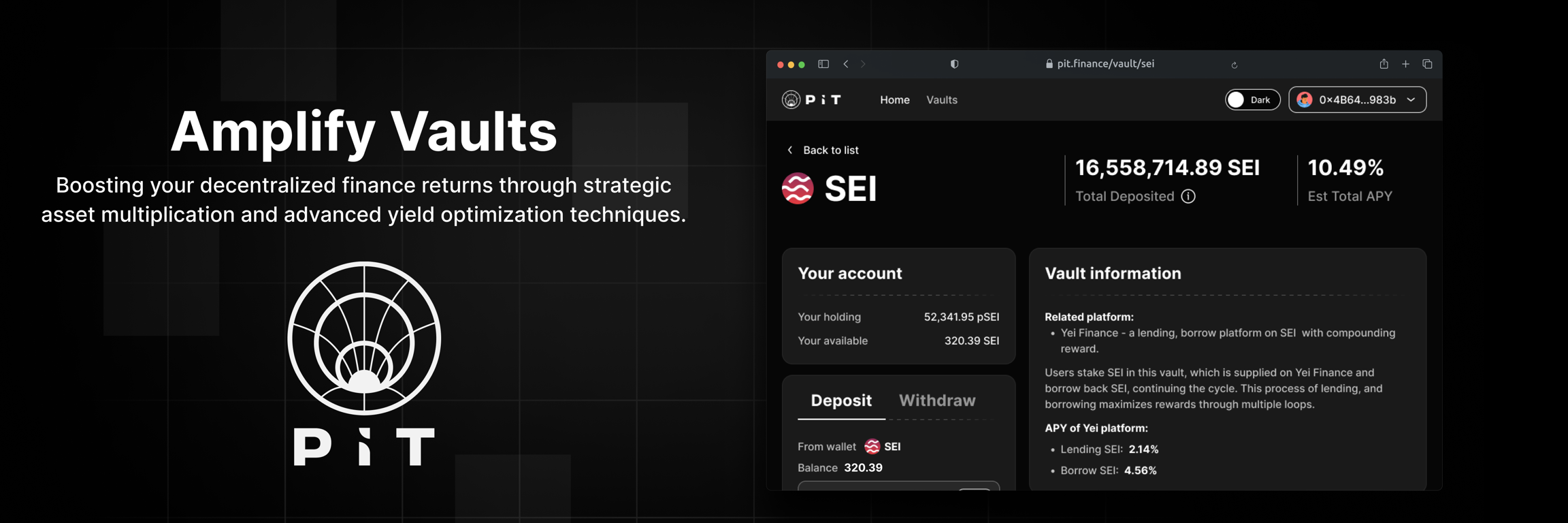

Pit strategies are modular smart contracts that manage the funds deposited into Vaults, optimizing their deployment across various DeFi opportunities such as lending/borrow pools, automated market makers (AMMs), liquid staking, and farming platforms.

When a user deposits assets into a Vault, these funds are immediately transferred to the targeted DeFi platform, such as Yei, where they are supplied (lent) to start earning rewards.

In addition to rewards from platforms like Yei, users also benefit from additional rewards provided by Pit Finance.

The Vault automatically harvests rewards from Yei every 6 hours, recalculating the value of pTOKENs to reflect the newly accrued earnings.

The reward will be re-invested to DeFi platform.

What Is the APY of a Vault?

The Annual Percentage Yield (APY) of a Vault represents the projected annual return on your deposited assets. In Pit Finance, when you deposit a token like SEI, iSEI, USDC, or USDT, you receive a corresponding pTOKEN that reflects your share in the Vault.

The Vault employs advanced DeFi strategies to generate rewards, which are harvested every 6 hours. Each time rewards are harvested, the value of your pTOKENs is recalculated to include the newly earned rewards. While APY can fluctuate due to market conditions and the performance of the underlying strategies, the regular 6-hour harvesting and recalculation process ensure that your earnings are consistently optimized.

Last updated