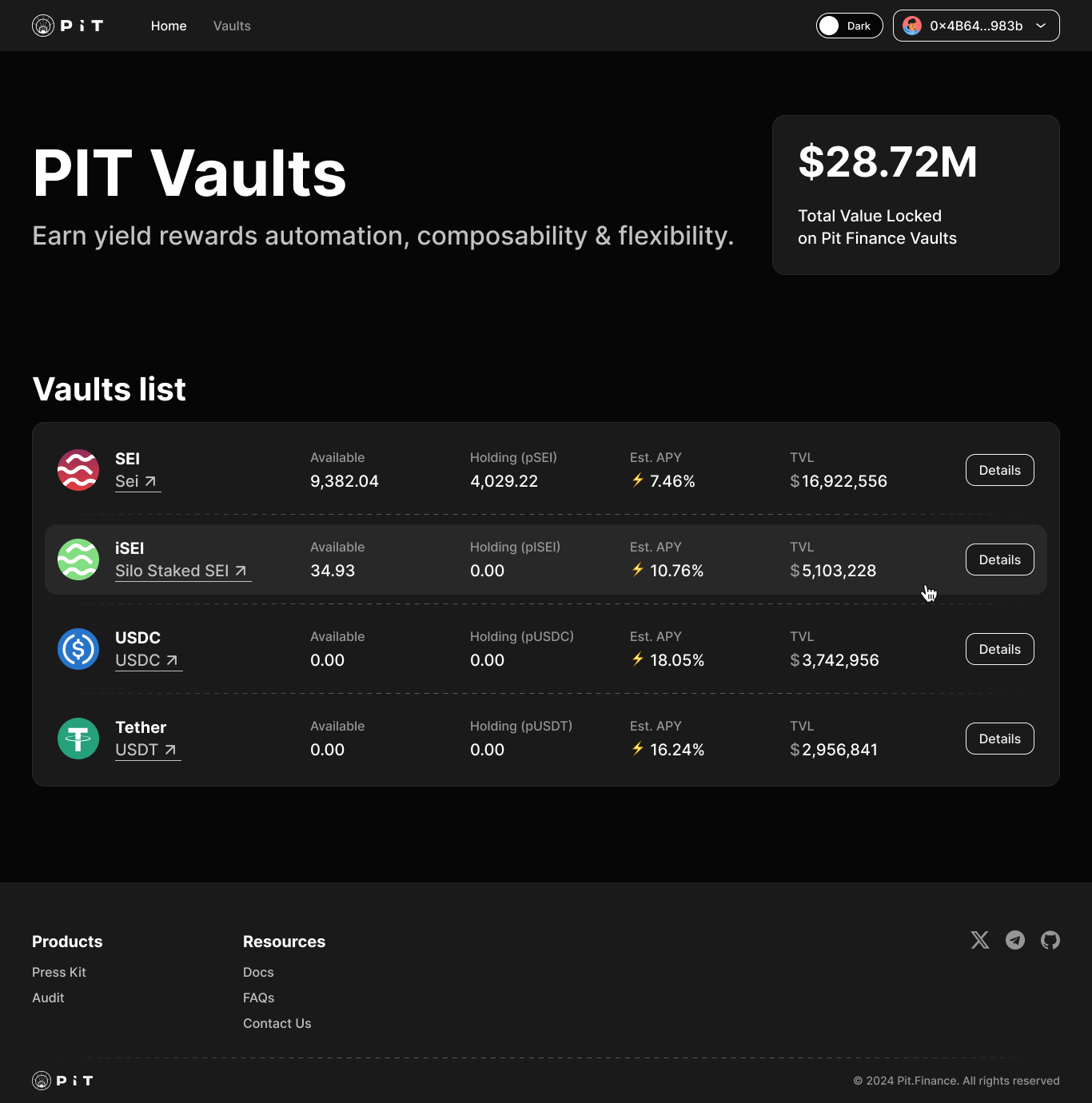

Vaults

Vaults in Pit Finance function like high-yield savings accounts for your crypto assets on the Sei Network. When you deposit assets into a Vault, they are automatically routed through smart contract-driven strategies that invest in various DeFi platforms such as liquidity pools, lending protocols, and staking opportunities. These strategies are designed to maximize returns by continuously optimizing and compounding your earnings.

Vault Fee Structure

Deposit/Withdrawal Fee: 0%

No fee is charged on deposits or withdrawals.

Management Fee: 0%

This fee (currently at 0%), typically a flat rate charged on Vault deposits annually, is extracted by minting new shares of the Vault, slightly diluting the holdings of all participants. The fee is calculated based on the time elapsed since the previous harvest and applied at the next harvest.

Performance Fee: 5% (on rewards)

A 5% fee is deducted from the yield earned each time a Vault harvests its strategy.

Last updated